Rs 2,000 notes won't be 'demonetised'; New Rs 200, Rs 50 notes on the way

FM Jaitley ruled out all allegation which stated that Rs 2,000 notes will be ban on August 23, 2017. However, Rs 200 and new Rs 50 notes will be out soon in the market.

Key Highlights:

- Govt does not plan to phase out Rs 2,000 notes, as per FM

- Old Rs 50 notes will continue to be legal tender

- Currency in circulation at Rs 15.70 lakh crore as on August 11, 2017

The Government of India has notified introduction of a new Rs 200 currency in to the Indian economy. The new Rs 200 note will be available from September onwards. Finance Minister Arun Jaitley in a cabinet briefing chaired by Prime Minister Narendra Modi also made it clear that Rs 2,000 note will continue to be legal tender.

There were rumours that Rs 2,000 note will be 'banned' as the Reserve Bank of India (RBI) top printing it this year. However, these allegations were put to rest when Jaitley said,“No discussion within Government, of phasing out Rs 2,000 notes,” tweeted by PIB.

LIVE: No discussion within Government, of phasing out Rs. 2000 notes: FM @arunjaitley https://t.co/Oi9HQt0hRm

— PIB India (@PIB_India) August 23, 2017

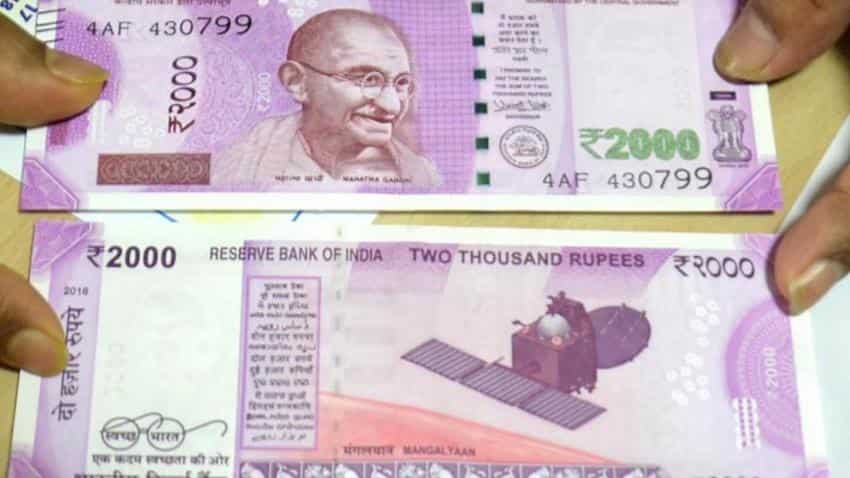

Rs 2000 notes were introduced in India by the RBI after Prime Minister Narendra Modi-led government decided to demonetise Rs 500 and Rs 1000 notes that constituted 86% of the total currency in circulation.

The new pink Rs 2000 note was issued in order to remonetise the Indian economy at a fast pace.

In regards Rs 200 notes, in a Gazzette notification, the Ministry of Finance on August 23, mentioned, “In exercise of the powers conferred by sub-section (1) of section 24 of the Reserve Bank of India Act, 1934 and on the recommendations of the Central Board of Directors of the Reserve Bank of India, the Central Government hereby specifies the denomination of bank notes of the value of two hundred rupees.''

News agency ANI on July 04, 2017 tweeted that the decision to introduce Rs 200 notes was taken by RBI with consultation of Finance Ministry in the month of March 2017. Also, RBI has already placed printing orders for the note.

The decision to introduce Rs. 200 notes was taken by RBI with consultation of Finance Ministry in March: Sources

— ANI (@ANI) July 4, 2017

According to reports, RBI is likely to put the proposed Rs 200 bank notes in circulation by the end of August or in the first week of September.

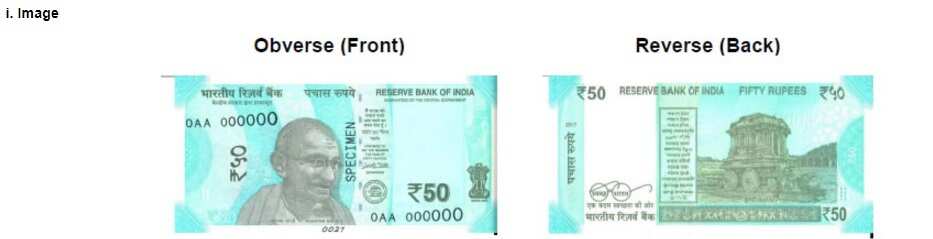

However, Rs 200 notes will not only be the new thing added in India's currency book soon. RBI had already launched the new look of Rs 50 notes in Mahatma Gandhi series on August 18, 2017.

It said, “The Reserve Bank of India will shortly issue Rs 50 denomination banknotes in the Mahatma Gandhi (New) Series, bearing signature of Dr Urjit R. Patel, Governor, Reserve Bank of India. The new denomination has motif of Hampi with Chariot on the reverse, depicting the country’s cultural heritage. The base colour of the note is Fluorescent Blue."

The new Rs 50 has other designs, geometric patterns aligning with the overall colour scheme, both at the obverse and reverse.

All the banknotes in the denomination of Rs 50 issued by the RBI in earlier series will continue to be legal tender.

At present, India had small denomination currency notes of Rs 1, Rs 2, Rs 5, Rs 10, Rs 20, old Rs 50, Rs 100 and high denomination notes of Rs 500 and Rs 2000.

While the impact of demonetisation on currency-in-circulation (CIC) has been minimized with over 87% of cash now 'remonetised'.

CIC as on August 11, 2017, stands nearly Rs 15.70 lakh crore compared to Rs 9.38 lakh crore in December 2016 (end of demonetisation) and Rs 17.97 lakh crore till November 04, 2017.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs Bank of Baroda 400-day FD: What will be maturity amounts on Rs 6 lakh and Rs 10 lakh investments for general and senior citizens?

SBI Latest FD Rates: This is what you can get on Rs 10 lakh investment in 1-year, 3-year, and 5-year tenures

11:07 AM IST

Intention of Centre to levy GST on petrol, diesel; states will have to decide on rate: Finance Minister

Intention of Centre to levy GST on petrol, diesel; states will have to decide on rate: Finance Minister Arun Jaitely 70th birth anniversary: A peek into the life of BJP's original Chanakya and trouble-shooter

Arun Jaitely 70th birth anniversary: A peek into the life of BJP's original Chanakya and trouble-shooter Arun Jaitley death anniversary: Remembering the architect of GST and BJP's trusted troubleshooter

Arun Jaitley death anniversary: Remembering the architect of GST and BJP's trusted troubleshooter PM Modi remembers former Finance Minister Arun Jaitley on death anniversary, says ‘miss my friend a lot’

PM Modi remembers former Finance Minister Arun Jaitley on death anniversary, says ‘miss my friend a lot’  Budget 2020: Nirmala Sitharaman pays homage to Arun Jaitley

Budget 2020: Nirmala Sitharaman pays homage to Arun Jaitley